A Digital Game to Improve How Index Insurance Promotes Resilience to Drought

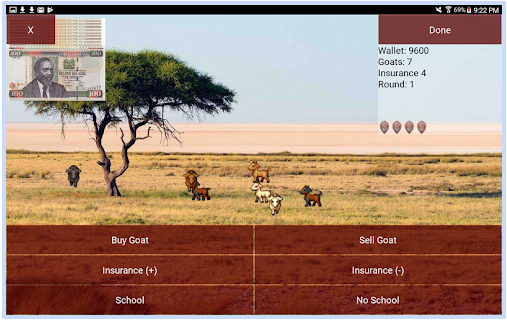

The game is simple. On a brown digital grassland with a single tree, tiny goats mill back and forth. When you decide how many of those goats to buy or sell and how many to insure, clouds float across the screen and one of two things happens: the clouds stop and rain falls, roughly doubling the goats and producing milk for sale, or the clouds move steadily across the screen and half your herd is wiped out.

The game is SimPastoralist, and it’s part of a MRR Innovation Lab project in northern Kenya that pairs a poverty graduation program for women and low-cost livestock insurance to promote resilience. The game gives pastoralist families who face a constant threat of devastating drought the experience of trying livestock insurance across many seasons. Also, data collected during the game is providing insights on how to design insurance that responds better to women’s needs.

“Women have a direct stake in what happens with the family’s livestock, but men typically have control of the herd,” said Michael Carter, director of the MRR Innovation Lab and the project’s leader. “If we make insurance more responsive to women, we can expand the support it provides to the family as a whole.”

Experimental Economics Made Digital

Index insurance has shown significant promise for promoting resilience but comes with its own challenges. Instead of providing payouts for losses a company representative can verify in person, index insurance is based on factors like weather or vegetation cover that predict losses. This difference, which significantly reduces the cost of insurance, also makes it more difficult to explain to rural families who have little experience with insurance of any kind.

Using experimental games to explain index insurance is not a new idea. For a decade, Carter and his colleagues have been doing just that around the world using poker chips, paper and dice. Using experimental games to study how people make decisions is an entire field of economics research.

The idea to use a digital version of Carter’s index insurance game was his research assistant Andrew Hobbs’ idea. Carter had just launched the project in Samburu, northern Kenya that pairs The BOMA Project’s Rural Entrepreneur Access Project (REAP) with Index-based Livestock Insurance (IBLI) from the International Livestock Research Institute (ILRI). Carter and his team are testing whether the insurance can help women who start businesses through REAP to hold onto their gains even when a drought threatens their livelihoods.

“Empowerment can be a tenuous achievement when there’s drought,” said Carter. “Insurance might help women to hold onto gains in income and empowerment while also helping them to avoid coping strategies that can sacrifice their family’s future wellbeing.”

Hobbs, a Ph.D. candidate in agricultural and resource economics at UC Davis, knew an app could solve at least one challenge of using a physical game. For example, with a room full of people playing, it might be easy for a member of the research team to accidentally transpose numbers or miss an occasional score. With a tablet-based app, everything gets recorded. The data on how people play can also be used to design insurance that responds better to their needs.

“Plus, video games are fun,” said Hobbs.

Taking SimPastoralist to Pastoralists

When Hobbs first shared SimPastoralist with the survey team in Kenya, they asked for changes right away. Many of them had grown up in pastoralist households. They were offended that the goats produced milk with no offspring. Completely unrealistic, they said. Hobbs asked what else he should change and got more feedback.

While SimPastoralist is a game, its value for research depends on how well it simulates real life. The decisions pastoralist families make from season to season about buying, selling or insuring goats, or sending their kids to school determine the courses of their lives.

Hobbs built SimPastoralist on his own in about 300 hours, and with minimal experience coding. The learning curve was steep, he said, but because he had built the app himself, he could incorporate feedback from his team then and there.

“Now this is like real life, is what they told me eventually,” said Hobbs.

The team used SimPastoralist to test two types of insurance. The first is a typical livestock insurance that provides cash payouts if livestock are threatened by severe drought. The other included the option of money for household expenses to make up for lost income.

When women and men played the game separately, the team found interesting differences in how they made decisions. When the insurance included the benefit of paying for household expenses, women bought more insurance but men bought much less. For women, the first spending priority after consumption was to pay for school for their children. For men, the first priority was to purchase more goats.

When couples played together, both had their own budget but shared all of the expenses in common. They could also transfer money back and forth.

“Playing the couples game you could judge their relationship,” said Watson Lepariyo, a research assistant with ILRI who trained and supervised the survey team. Lepariyo is also from Samburu. “How they played the game reflects what they do on the outside.”

A New Understanding of Index Insurance

Lepariyo said that one of the biggest challenges of taking index insurance to the field is educating families about how it works. For the MRR Innovation Lab project in Samburu, everyone played the game ten times. For anyone who made it all ten rounds each game had the experience of 100 simulated seasons. To gain this much experience in real life with insurance would take a lifetime.

The MRR Innovation Lab has also used SimPastoralist with policy makers. With some tweaks, Carter and his team used the app to illustrate differences between index insurance that pays out accurately for losses and insurance that would fail a minimum test for quality. In February, 2019, 85 government officials and representatives from the local insurance industry, international NGOs and USAID played SimPastoralist at an event hosted by the Uganda Ministry of Finance, Planning and Development.

“To me it is a powerful tool when you want to teach someone quickly,” said Lepariyo. “It’s more of an experience they have. Everyone who participates truly understands index insurance.”